Accessing Your 1098-T

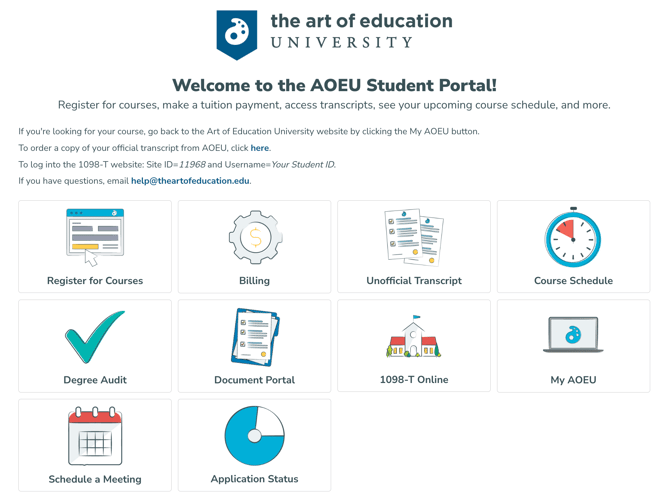

Your 1098-T can be accessed through your Student Portal.

Your 1098-T form reports the amount of eligible tuition and fees paid during the year to The Art of Education University.

Individuals can not claim a tax deduction using Form 1098-T if a school district, PTO, non-profit organization, or another individual (excluding a spouse), provided the funds to purchase these courses. As a recipient of a 1098-T form, you are responsible for ensuring its appropriate use for tax purposes. Please consult your tax advisor if you have any questions regarding claiming it as a tax deduction.

To access the 1098-T website, you will go to www.tsc1098t.com. A link to the website is also available from the Home page of your student portal.

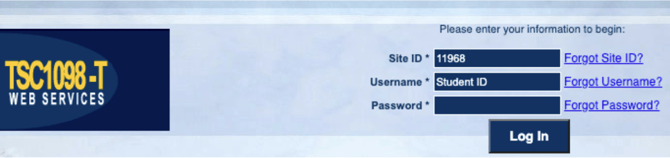

To log in, you will enter AOEU’s site ID 11968, your AOEU Student ID, and a password. The first time you log in, your password will be the last four digits of your Social Security Number. Then you will be prompted to change your password. The new password must be at least 8 characters and contain at least one upper case letter, one lower case letter, one numeric character, and one special character.

Need help finding your Student ID? Find the steps to locate it here.

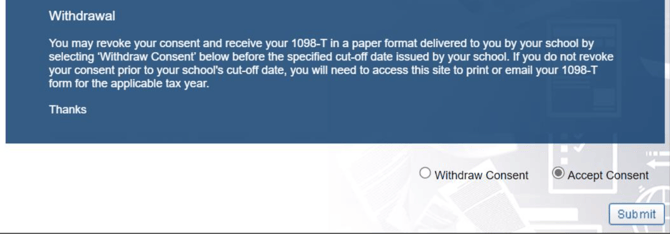

Also, the first time you will be presented with the Online Consent Form. You must accept or deny consent before accessing the Home Screen. If consent is provided, your Form 1098-T will be provided electronically rather than by mail. (Please note the system requirements listed on the consent message. However, if online consent is not given, Form 1098-T will be mailed to the address listed on your AOEU student profile as of January 1st.

View or Print 1098-T

Select the year, and then View/Print my 1098-T

In your browser window (i.e., Chrome, Internet Explorer, etc.), you will receive a prompt for downloading and viewing the file.

Click Open to view the file directly in the browser or Save to save the file within the Downloads folder. Use the Down Arrow to the right of the Save option to select a different save location. (NOTE: The steps may be different depending on your browser.)

The form will be displayed automatically in a new tab within your current browser window and appear as shown below:

Reset Password

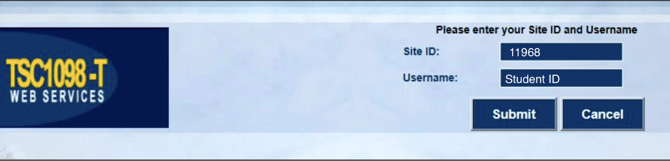

The Forgot Password? function may be used to reset your password by entering your Site ID 11968 and Student ID.

Then an email will be sent to your @students.theartofeducation.edu email address. If you do not receive it, make sure to check your spam filters.

Then an email will be sent to your @students.theartofeducation.edu email address. If you do not receive it, make sure to check your spam filters.

Online Consent

To provide or revoke consent to receiving your 1098T electronically, click on Online Consent in the left navigational panel.

Then the consent form will appear. Scroll down to read then click either Withdraw Consent or Accept Consent and Submit.

You will receive a confirmation message to show that consent was given or withdrawn.

You will receive a confirmation message to show that consent was given or withdrawn.

Logging Out

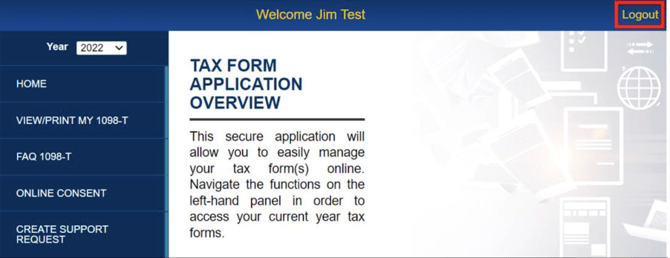

To log out, click on Logout located in the upper right corner of the screen.

If you have any questions regarding Form 1098-T, please email us at bursar@theartofeducation.edu.